| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

- 가계부

- List box

- 오라클 함수

- UTF-8

- function

- EUC-kr

- ALV

- Smart Forms

- selection screen

- gimp

- Standard Function

- FI 용어정리

- 엑소버드

- 스마트폼

- ole

- alv 정형화

- Java

- 유닉스

- SAP

- sapa

- 동적 쿼리

- Enhancement

- ABAP

- EXIT

- KOSA

- 방화벽

- badi

- fi

- 이명박

- 머니플랜

- Today

- Total

Drunken Lion

Difference in Asset Depreciation in S4HANA and ECC 본문

출처 : https://www.linkedin.com/pulse/difference-asset-depreciation-s4hana-ecc-prithvi-sorout

Difference in Asset Depreciation in S4HANA and ECC

This is going to be my First self-written Document on SAP S4HANA and ECC. For Freshers who would like to start their career in SAP, this will be completely a new topic all together.

www.linkedin.com

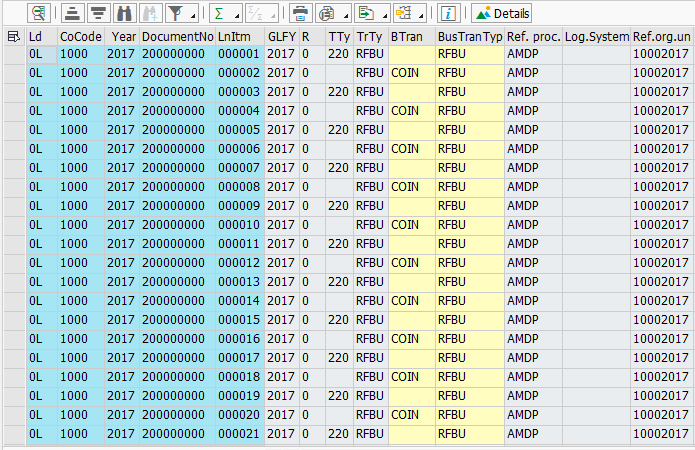

HANA에서 감가상각 전기 전표를 보니, 자산별로 Line item 이 생성되어 있음.

아래 차이 때문..

This is going to be my First self-written Document on SAP S4HANA and ECC.

For Freshers who would like to start their career in SAP, this will be completely a new topic all together. But still my suggestion would be to understand the major differences in Asset Depreciation in S4HANA and ECC.

For all my experienced colleagues, this topic would be as interesting as it is for me to write about it.

In Asset Accounting, for depreciation we still use the previous AFAB or AFABN transaction codes but it is now mapped to a new program which is FAA_DEPRECIATION_POST. The initial programme RAPOST2000 and RAPOST2010 are not being used now. Below are the screenshots of AFAB transaction in ECC and S4HANA.

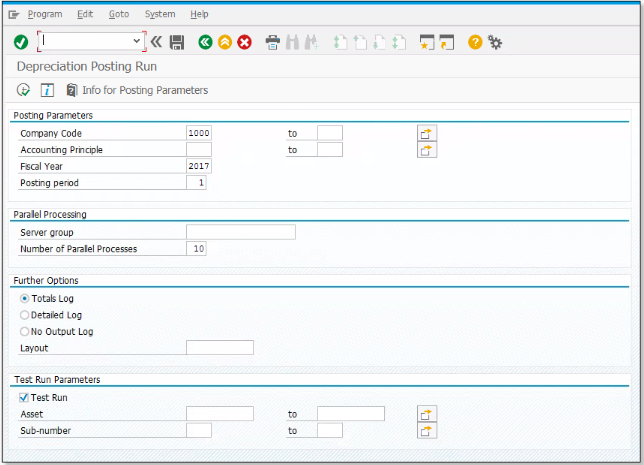

AFAB in ECC:

AFAB in S4HANA:

As per the screenshots, you will be able to analyse major changes in the screen itself. I would like to explain few changes in details between ECC and S/4HANA.

· S4HANA - The major change which is there in S4HANA is related to table ACDOCA. We can get complete details of the posting at GL’s also and can get report of the data posted in the accounting principle and Fiscal Period.

· ECC – Whenever we used to run the depreciation it used to update ANLP table and then it used to get updated in the GL tables. First, it would summarize the depreciation values for every account and then creates its own internal asset document. Then it will create these asset document into multiple line items in an FI Document. In ECC it will be difficult to find the actual amount posted per asset and period. ANLP table had the information but not BSEG. Now, ACDOCA will show us the amounts posted per asset, per period, and per accounting principle.

In the below screenshot the document is posted by FAA_DEPRECIATION_POST. While the asset field isn’t shown, the description column shows the asset number that is credited in each line item. This is the big change we can now see the posted depreciation at an asset level from within the GL.

The underlying source is ACDOCA. For this same FI document, the table is recording the data per ledger.

· A major change that SAP has made has to do with errors that hold up the depreciation run. In ECC, the FI document created by the depreciation run would post the Document only if there is no error in the assets. Even if a single asset contains any error, then all of the other assets that were summarized in that particular FI document would also not get posted. You had to then execute the program in Restart mode after you fixed the underlying error. This is no longer the case in S/4HANA. The assets without errors are allowed to post and only the assets that errored out will be held back. We can even complete the month end closing activity and move on to the next period in this situation. However, at year end, we’ll need to correct all the errors which we skipped during the Period run in order to close out the fiscal year. In this, the point is a single error on one asset won’t hold up the posting of depreciation for other assets.

· You can now execute the depreciation run for multiple company codes. Previously in ECC, it was only possible to execute depreciation for a range of company codes by directly executing program RAPOST2010. RAPOST2010 wasn’t mapped to any tcode so few customers were aware of it. Now in S/4HANA, the main (and only) program allows you to execute it for multiple company codes.

· The selection screen has changed in a few noticeable ways. First, there were four options under “Reason for Posting Run” which are no longer available. In S4HANA new program will correctly determine what type of depreciation run you are making so the options are no longer there.

· As in ECC, we’ll see the options regarding parallel processing on the selection screen but how they’re used has changed in S4HANA. In ECC, this posting program would only run in parallel if a server group was specified. Till date I have never used it in any of the Indian Client. If you leave the Server Group blank in S/4HANA, it has the opposite effect. In this case it will always run in parallel on all available servers using the number of processes specified (10 is the default). In order to control how that parallelization works we have to configure a server group accordingly.

· There is a new button at the top [Info for Posting Parameters]. This will display the basics of the most recent execution run per company and accounting principle. Previously, the only way to figure out what period was last posted was to look at table T093D or TABA. This feature brings that same posting status information to the user side. This was available previously in ECC but required the activation of a business function. Now this functionality is available for every user.

The underlying source is ACDOCA. For this same FI document, the table is recording the data mentioned below:

Ledger (accounting principle)

Depreciation area (that posts to the GL)

Asset

Fiscal year/period

Depreciation period

The biggest benefit though will be the increased GL detail. Now that the integration between FI-AA and the GL is much tighter in S/4HANA as compared to ECC, it’s good to see that we have greater asset details in the actual FI documents. The new program is supposed to be much faster in its execution. The program no longer has to read ANLC and calculate the planned amount to be posted per asset. This was an expensive read of a large table. Now in S/4HANA, the program just reads FAAT_PLAN_VALUES for the appropriate period to be posted.

I hope this would be an add on to your knowledge. Looking forward for your feedback.

-Prithvi Sorout (SAP Professional Certified)

'SAP > FI' 카테고리의 다른 글

| S/4HANA System Conversion Pre-check setting up Customer Vendor Integration (0) | 2020.01.23 |

|---|---|

| New Asset Accounting: Transactions with Integrated Postings (0) | 2020.01.22 |

| SEM-BCS T-CODE (0) | 2018.12.05 |

| Consolidation Tasks (0) | 2018.12.05 |

| 금 구리 철 스크랩 분개 (0) | 2016.10.14 |